Market Insights with Sensibull FII DII Data

In the dynamic world of stock markets, having access to reliable and timely data is crucial for making informed investment decisions. Sensibull FII DII data offers investors a comprehensive view of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) activities. By leveraging this data, traders can gain valuable insights into market trends, sentiment, and potential price movements. This blog post delves into the significance of Sensibull FII DII data, its features, and how it can enhance your trading strategy.

Sensibull FII DII Data

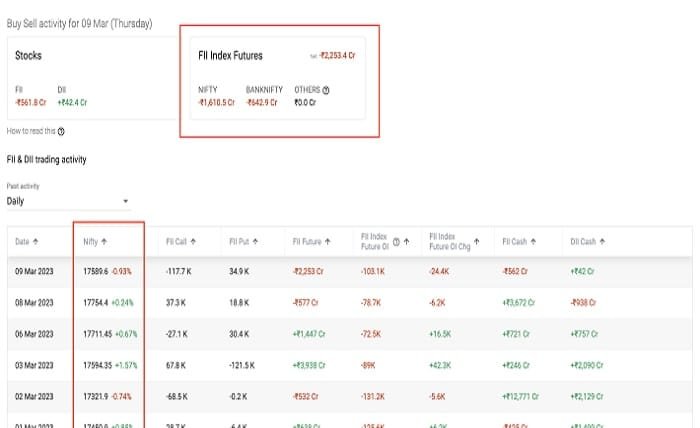

Sensibull FII DII data provides detailed information on the buying and selling activities of FIIs and DIIs in the stock market. FIIs are entities like hedge funds and investment banks that invest large sums in the market from abroad, while DIIs are domestic investment institutions. Sensibull aggregates this data to offer real-time updates, enabling investors to track the flow of capital. Understanding Sensibull FII DII data helps investors gauge market sentiment and identify potential investment opportunities based on institutional actions.

The Importance of FII DII Data in Trading

Access to Sensibull FII DII data is essential for traders aiming to align their strategies with institutional movements. FIIs and DIIs often have significant influence on stock prices due to the large volumes they trade. By analyzing Sensibull FII DII data, investors can detect patterns such as accumulation or distribution phases. This information can signal bullish or bearish trends, allowing traders to make proactive decisions. Incorporating Sensibull FII DII data into your analysis can enhance the accuracy of your market predictions.

Features of Sensibull FII DII Data

Sensibull FII DII data comes packed with features designed to provide comprehensive market insights. These include real-time tracking of FII and DII transactions, historical data analysis, and visualization tools like charts and graphs. Additionally, Sensibull offers alerts and notifications for significant changes in institutional activities. The platform’s user-friendly interface makes it easy to interpret Sensibull FII DII data, even for novice investors. These features collectively empower traders to make data-driven decisions with confidence.

How to Access Sensibull FII DII Data

Accessing Sensibull FII DII data is straightforward through the Sensibull platform. Investors need to create an account and subscribe to the relevant plans that include FII and DII data services. Once subscribed, users can navigate to the dedicated section for institutional data, where they can view real-time updates, historical trends, and detailed reports. Sensibull also provides tutorials and customer support to help users make the most of Sensibull FII DII data, ensuring that they can effectively integrate it into their trading strategies.

Benefits of Using Sensibull FII DII Data

Utilizing Sensibull FII DII data offers numerous benefits for investors. It enhances decision-making by providing clear insights into institutional trading patterns. This data helps in identifying potential market movements before they become apparent to the general public. Additionally, Sensibull FII DII data can improve risk management by highlighting trends that may indicate market volatility. The ability to access and interpret this data efficiently allows traders to stay ahead of the curve and optimize their investment portfolios for better returns.

Sensibull FII DII Data vs. Traditional Analysis

While traditional market analysis relies heavily on technical indicators and fundamental analysis, Sensibull FII DII data adds an extra layer of depth. By focusing on institutional activities, this data provides a unique perspective that is often overlooked in conventional analysis. Sensibull FII DII data complements traditional methods by offering insights into the actions of major market players, thereby enhancing the overall analysis. Integrating Sensibull FII DII data with traditional techniques can lead to more robust and well-rounded trading strategies.

Real-World Applications of Sensibull FII DII Data

Sensibull FII DII data has practical applications across various trading strategies. For instance, swing traders can use this data to identify entry and exit points based on institutional buying or selling trends. Long-term investors might leverage Sensibull FII DII data to assess the stability and growth potential of their investments by monitoring sustained institutional interest. Additionally, day traders can benefit from real-time updates to make quick, informed trades. The versatility of Sensibull FII DII data makes it a valuable tool for traders with diverse investment approaches.

Case Studies: Success Stories with Sensibull FII DII Data

Several investors have reported significant improvements in their trading outcomes by incorporating Sensibull FII DII data into their strategies. For example, a trader identified a consistent increase in FII buying activity in a particular sector, leading to timely investments that yielded substantial returns. Another investor used Sensibull FII DII data to anticipate a market downturn by noticing a spike in DII selling, allowing them to hedge their portfolio effectively. These case studies highlight the practical benefits and effectiveness of using Sensibull FII DII data in real-world trading scenarios.

Integrating Sensibull FII DII Data with Other Tools

Sensibull FII DII data can be seamlessly integrated with other trading tools and platforms to enhance its utility. For instance, combining this data with technical analysis software can provide a more comprehensive market view. Investors can also use Sensibull FII DII data alongside news feeds and economic indicators to create a holistic trading strategy. Sensibull’s API allows for integration with various third-party applications, enabling users to customize their data analysis workflows. This flexibility ensures that Sensibull FII DII data can be tailored to fit individual trading styles and requirements.

Future Trends: The Evolution of Sensibull FII DII Data

The landscape of financial data is continuously evolving, and Sensibull FII DII data is poised to keep pace with these changes. Future developments may include more advanced analytics, machine learning integration, and enhanced visualization capabilities. Sensibull is likely to expand its data offerings to include more granular insights into institutional behaviors and market dynamics. As the importance of institutional data grows, Sensibull FII DII data will remain a critical resource for investors seeking to navigate increasingly complex financial markets.

Conclusion

Incorporating Sensibull FII DII data into your investment strategy can significantly enhance your ability to make informed trading decisions. By providing detailed insights into the activities of FIIs and DIIs, Sensibull empowers investors with the information needed to anticipate market movements and optimize their portfolios. Whether you are a novice trader or an experienced investor, leveraging Sensibull FII DII data can give you a competitive edge in the fast-paced world of stock markets. Embrace this powerful tool to stay ahead and achieve your financial goals with confidence.

FAQs

1. What is Sensibull FII DII data?

Sensibull FII DII data refers to the information provided by Sensibull regarding the trading activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) in the stock market. This data helps investors understand institutional market movements.

2. How can I access Sensibull FII DII data?

To access Sensibull FII DII data, you need to create an account on the Sensibull platform and subscribe to a plan that includes institutional data services. Once subscribed, you can view real-time and historical FII and DII data through the platform’s interface.

3. Why is Sensibull FII DII data important for investors?

Sensibull FII DII data is crucial because it provides insights into the actions of major market players. Understanding FII and DII activities can help investors gauge market sentiment, identify trends, and make informed trading decisions based on institutional behavior.

4. Can Sensibull FII DII data be integrated with other trading tools?

Yes, Sensibull FII DII data can be integrated with various trading tools and platforms. Sensibull offers APIs and compatibility features that allow users to combine institutional data with technical analysis software, news feeds, and other trading resources for a comprehensive market analysis.

5. Are there any tutorials available for using Sensibull FII DII data?

Absolutely. Sensibull provides tutorials and customer support to help users effectively utilize Sensibull FII DII data. These resources guide investors on how to interpret the data, integrate it into their strategies, and maximize its benefits for better trading outcomes.