FII DII Data on StockEdge: An Essential Guide

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are pivotal players in the stock market, influencing the indices with their investment choices. The tracking of FII DII data on platforms like StockEdge provides investors with insights into how these big players are moving in the market. This data is crucial for understanding market trends, predicting future movements, and making informed investment decisions. By analyzing FII DII data on StockEdge, investors can get a clearer picture of the market sentiment, helping them to align their strategies with institutional activities.

Importance of Tracking FII DII Data on StockEdge

The importance of monitoring FII DII data on StockEdge cannot be overstated. FIIs have significant financial power and can influence market trends through their investment decisions. DIIs, including mutual funds, insurance companies, and pension funds, also play a critical role in stabilizing the market with their substantial investments. By tracking how these entities interact with the market, FII DII data on StockEdge helps investors to gauge market moods and potential shifts. Understanding these trends is essential for retail investors who look to institutional activities as indicators of market health.

How FII DII Data on StockEdge Impacts Stock Prices

The impact of FII and DII activities on stock prices is significant. When FIIs invest heavily in the market, it generally leads to an increase in stock prices due to the high demand. Conversely, when they pull out, it can cause the market to fall. The FII DII data on StockEdge helps investors to track these investment patterns in real time. This data allows investors to anticipate market movements and position their portfolios accordingly. For example, a sustained selling trend by FIIs might suggest a bearish market outlook, prompting investors to adopt more defensive strategies.

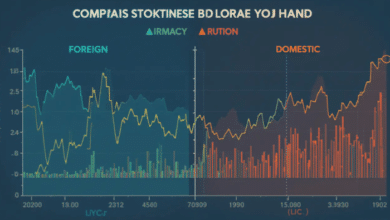

Analyzing Market Trends with FII DII Data on StockEdge

FII DII data on StockEdge is an excellent tool for analyzing long-term market trends. By examining the historical data of FII and DII investments, investors can identify patterns and trends that recur over time. This analysis can reveal whether FIIs and DIIs are bullish or bearish on particular sectors or the overall market. Moreover, StockEdge provides graphical representations of FII DII data, making it easier to visualize these trends and derive actionable insights. This strategic advantage helps investors in making more precise and timed investment decisions.

Benefits of Using FII DII Data on StockEdge for Day Trading

Day traders can greatly benefit from using FII DII data on StockEdge. This data provides insights into the immediate reactions of institutional investors to market events or economic indicators. For day traders, understanding these short-term movements is crucial for capitalizing on quick profit opportunities. FII DII data on StockEdge helps them identify which stocks are likely to experience volatility or significant price movements, based on institutional buying or selling. This real-time data is crucial for day traders aiming to make quick decisions.

Strategic Investment Planning with FII DII Data on StockEdge

For long-term investors, FII DII data on StockEdge is invaluable for strategic investment planning. This data aids in identifying the sectors and stocks where institutional investors are focusing their resources over an extended period. By aligning their investment strategies with those of the institutions, long-term investors can potentially increase their chances of successful returns. FII DII data on StockEdge allows for a deeper analysis of the investment trends, helping investors to build a diversified and resilient portfolio.

The Role of FII DII Data on StockEdge in Mutual Fund Investments

Mutual fund managers extensively use FII DII data on StockEdge to guide their investment decisions. This data provides them with insights into how other institutional investors are adjusting their portfolios in response to market conditions. By analyzing FII and DII trends, mutual fund managers can better position their funds to attract potential investors by aligning with the dominant market forces. For individual investors, understanding these trends through FII DII data on StockEdge can help in selecting the right mutual funds that are likely to perform well.

FII DII Data on StockEdge for Portfolio Diversification

Using FII DII data on StockEdge can significantly aid in portfolio diversification. This data helps investors understand which sectors or stocks are currently favored or disfavored by institutional investors. By knowing where the big money is moving, individual investors can make informed decisions about diversifying their investment across various sectors. Diversification is key to managing risk, and aligning with institutional trends can mitigate investment risks and enhance portfolio performance.

Limitations of FII DII Data on StockEdge

While FII DII data on StockEdge is a powerful tool for investors, it is not without limitations. This data must be interpreted within a broader context of overall market conditions and economic indicators. Sometimes, institutional investment patterns might be misleading due to short-term strategic adjustments rather than long-term commitments. Investors should use this data in conjunction with other analysis tools and economic indicators available on StockEdge to make well-rounded investment decisions.

How to Access and Use FII DII Data on StockEdge

Accessing and using FII DII data on StockEdge is straightforward. Users can subscribe to StockEdge and navigate to the dedicated section for institutional investments. The platform offers detailed analytics and easy-to-understand graphical representations of FII and DII activities. For new users, StockEdge provides tutorials and support to help understand how to best utilize the data provided. Regular updates and alerts on FII DII activities make it easier for users to stay informed about significant market movements.

Conclusion

FII DII data on StockEdge is a critical resource for any investor seeking to understand and anticipate market movements influenced by institutional investments. While this data is powerful, it should be used as part of a broader investment strategy that considers various market signals and economic indicators. By leveraging the insights provided by FII DII data on StockEdge, investors can make more informed decisions, align their strategies with institutional trends, and potentially enhance their investment returns.

FAQs

- What does FII and DII stand for in FII DII data on StockEdge?

- FII stands for Foreign Institutional Investors, and DII stands for Domestic Institutional Investors. These terms refer to types of investors that influence stock markets through their large-scale buying and selling activities.

- How current is the FII DII data on StockEdge?

- StockEdge updates its FII DII data regularly, ensuring that users have access to the most recent information to make informed trading and investment decisions.

- Can FII DII data on StockEdge predict market crashes?

- While FII DII data can provide insights into market trends and potential shifts, it cannot predict market crashes definitively. It should be used in combination with other market analysis tools for best results.

- Is FII DII data on StockEdge suitable for beginner investors?

- Yes, StockEdge provides a user-friendly interface and educational resources that make FII DII data accessible and useful for investors at all levels, including beginners.

- How can I integrate FII DII data from StockEdge into my investment strategy?

- Investors can integrate FII DII data into their strategy by using it to track institutional trends, align their investment decisions with these trends, and adjust their portfolio based on the insights provided by this data.