FII DII Data Live: Key Insights for Investors

Investors and traders constantly look for data to make informed decisions, and FII DII data live is one such vital piece of information in the stock market. It helps market participants understand foreign institutional investors (FII) and domestic institutional investors (DII) activity in real-time. In this article, we’ll explore the importance, impact, and methods to track FII DII data live, making it an essential part of any investor’s toolkit.

What is FII DII Data Live?

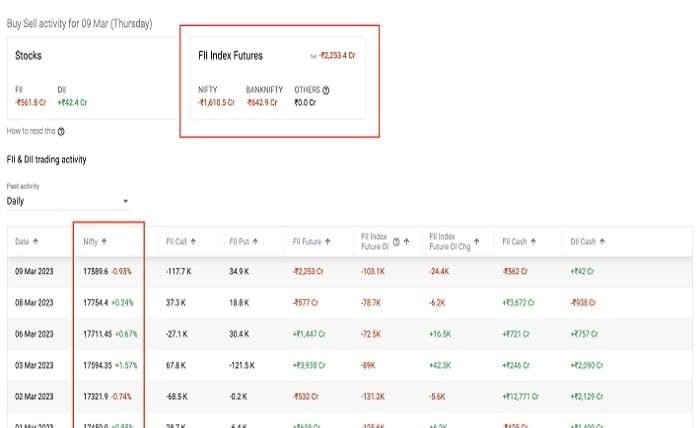

FII DII data live refers to the real-time data of trading activities by Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) in the stock market. FIIs are investors from abroad, while DIIs are local institutions. By examining FII DII data live, investors can gain insights into market trends, predicting whether FIIs and DIIs are buying or selling, thus affecting stock prices and indices.

Importance of FII DII Data Live for Investors

Tracking FII DII data live is crucial for investors, as it offers a clear understanding of institutional flows in the market. FIIs, with their large capital, significantly impact stock prices and indices, while DIIs offer a counterbalance. By analyzing FII DII data live, investors can predict potential price movements and market trends, helping them make informed investment decisions aligned with institutional activities.

How to Access FII DII Data Live

Accessing FII DII data live is straightforward, with multiple platforms providing real-time updates. Websites of stock exchanges, financial news portals, and investment apps often feature this data. By regularly checking these sources, investors can track FII DII data live and incorporate this information into their trading strategies, ensuring they stay updated on institutional moves in the market.

The Impact of FII DII Data Live on Stock Markets

The influence of FII DII data live on the stock market is substantial, as it directly reflects the investment actions of FIIs and DIIs. Heavy FII buying generally boosts stock prices, while large-scale selling can lead to a decline. Similarly, DII activity provides stability to the market, countering FII fluctuations. Understanding FII DII data live can help investors anticipate market direction and adjust their portfolios accordingly.

FII DII Data Live and Market Volatility

Market volatility is often linked with shifts in FII DII data live. When FIIs engage in significant buying or selling, the market experiences increased volatility. DIIs, however, often act as stabilizers by countering FII movements. By closely monitoring FII DII data live, traders can gauge potential market volatility and prepare their trading strategies to manage risks effectively.

Analyzing FII DII Data Live for Better Investment Decisions

Using FII DII data live effectively requires analysis to identify trends. For instance, consistent FII buying might indicate positive sentiment toward the market, while persistent selling could signal caution. Similarly, analyzing DII actions can help understand market support levels. Thus, integrating FII DII data live analysis into investment strategies enables investors to align their decisions with institutional sentiment.

Differences Between FII and DII Activities in Data Live

FII DII data live reveals different investment behaviors: FIIs are often influenced by global trends, while DIIs typically focus on domestic factors. FIIs may react to international news, currency fluctuations, and global economic indicators, while DIIs prioritize national policies and local economic factors. Recognizing these differences in FII DII data live helps investors better interpret each group’s influence on market movements.

Tools and Platforms for Tracking FII DII Data Live

Several tools and platforms help investors monitor FII DII data live. Popular options include stock exchange websites, financial news portals, and real-time data apps. Platforms like Moneycontrol, NSE, and BSE offer regular updates, allowing investors to track institutional activities easily. Leveraging these tools, investors can analyze FII DII data live and make timely decisions based on institutional flows.

Using FII DII Data Live to Predict Market Trends

By examining FII DII data live, investors can often predict upcoming market trends. For instance, continuous FII inflows usually indicate positive market momentum, while consistent outflows may signal caution. DIIs may step in to stabilize when FIIs withdraw, providing market support. Therefore, keeping an eye on FII DII data live enables investors to anticipate trends and adjust their strategies for optimal results.

Limitations of FII DII Data Live Analysis

While FII DII data live is valuable, it has limitations. Institutional activities don’t always predict market movements accurately due to complex influencing factors, such as government policies and global economic conditions. Therefore, investors should use FII DII data live as part of a comprehensive strategy, considering other fundamental and technical analyses for well-rounded investment decisions.

Conclusion

FII DII data live is a powerful tool for investors to gauge institutional sentiment and market trends. By understanding the buying and selling patterns of FIIs and DIIs, investors can make more informed choices, align with market movements, and manage volatility effectively. Although not foolproof, FII DII data live is an essential component of an investor’s toolkit, offering insights that, when combined with other analyses, can lead to profitable outcomes.

FAQs

1. What does FII DII data live mean?

FII DII data live refers to real-time data of trading activities by Foreign and Domestic Institutional Investors in the stock market.

2. Why is FII DII data live important for investors?

Tracking FII DII data live helps investors understand market trends, predict price movements, and align with institutional activities.

3. Where can I find FII DII data live?

Investors can access FII DII data live on stock exchange websites, financial news portals, and various real-time investment platforms.

4. How does FII DII data live impact market volatility?

Significant FII or DII activity often influences market volatility, with FIIs typically increasing volatility and DIIs providing stability.

5. Can FII DII data live accurately predict market trends?

While FII DII data live offers insights, it has limitations and should be used alongside other analyses for accurate market predictions.