FII DII Data: A Comprehensive Guide to Stock Market Trends

Introduction

The financial markets are often influenced by various factors, with Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) playing pivotal roles. Understanding FII DII data is crucial for investors aiming to make informed decisions in the stock market. This data provides insights into the buying and selling activities of institutional investors, which can significantly impact market trends. In this comprehensive guide, we’ll delve into the intricacies of FII DII data, exploring its importance, how to interpret it, and its impact on the stock market.

What is FII DII Data?

FII DII data refers to the trading activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) in the stock market. FIIs are entities from outside the country that invest in the local financial markets, while DIIs are domestic institutions, such as mutual funds and insurance companies, that invest within their own country. The FII DII data includes details about their net purchases or sales of securities on a daily, weekly, or monthly basis. By analyzing this data, investors can gauge market sentiment and predict future trends.

The Importance of FII DII Data in Stock Market Analysis

The significance of FII DII data in stock market analysis cannot be overstated. This data acts as a barometer for market sentiment, reflecting the confidence of institutional investors in the market. When FIIs and DIIs are net buyers, it generally indicates a bullish market sentiment, while net selling by these institutions can signal bearish trends. Investors closely monitor FII DII data to align their strategies with the prevailing market conditions and to anticipate potential market movements.

How FII DII Data Affects Stock Market Movements

FII DII data has a direct impact on stock market movements. Large-scale buying by FIIs can lead to a surge in stock prices, while significant selling can trigger a market downturn. DIIs, on the other hand, often act as a stabilizing force, counterbalancing the actions of FIIs. For instance, when FIIs withdraw funds, DIIs might increase their investments to stabilize the market. Analyzing FII DII data helps investors understand these dynamics and predict how the market might react to various economic and geopolitical events.

How to Interpret FII DII Data

Interpreting FII DII data requires a keen understanding of market dynamics. Investors should look at both the net inflows and outflows of FIIs and DIIs over a period. Consistent net buying by FIIs is a positive indicator, suggesting strong foreign interest in the market. Conversely, continuous net selling might indicate caution or pessimism among foreign investors. Similarly, DII activity provides insights into the confidence of domestic institutions in the market. By analyzing FII DII data trends, investors can make more informed decisions about when to enter or exit the market.

Sources of FII DII Data

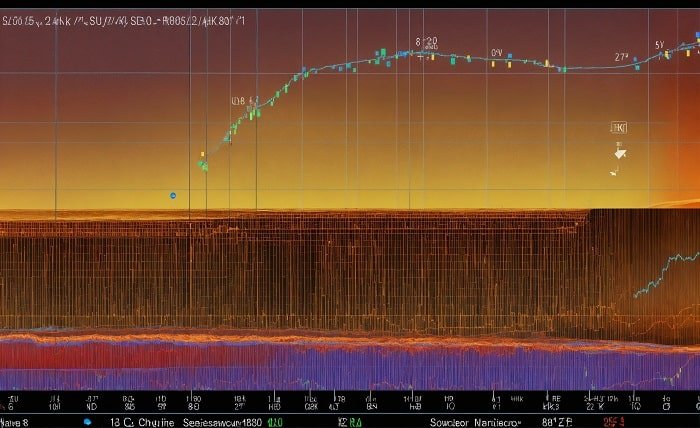

There are several reliable sources where investors can access FII DII data. Stock exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India publish daily FII and DII trading activity reports. Financial news platforms and investment research websites also provide detailed FII DII data with historical trends and analysis. It’s important for investors to use accurate and up-to-date sources to ensure they are making decisions based on the latest information.

The Role of FII DII Data in Portfolio Management

FII DII data plays a crucial role in portfolio management. By tracking the investment patterns of institutional investors, individual investors can adjust their portfolios to align with market trends. For example, if FII DII data shows a surge in FII investments in a particular sector, it might be a signal to increase exposure to that sector. Conversely, if the data indicates heavy selling by DIIs in a certain industry, it might be wise to reduce holdings in that area. Incorporating FII DII data into portfolio management strategies can enhance returns and minimize risks.

Analyzing Historical FII DII Data

Analyzing historical FII DII data provides valuable insights into market trends over time. By studying past data, investors can identify patterns and correlations between institutional investor behavior and market movements. For instance, a historical analysis of FII DII data might reveal that FII inflows tend to increase during periods of economic stability and decrease during times of uncertainty. This understanding can help investors anticipate future market trends and make more informed investment decisions.

The Impact of Global Events on FII DII Data

Global events have a significant impact on FII DII data. Events such as geopolitical tensions, changes in global interest rates, and major economic policies can influence the behavior of institutional investors. For example, an increase in interest rates in developed economies might lead to a withdrawal of FII investments from emerging markets, reflecting in the FII DII data. Similarly, domestic events like elections, budget announcements, and monetary policy decisions can affect DII behavior. Monitoring how FII DII data responds to global events is essential for investors looking to navigate the complexities of the stock market.

The Future of FII DII Data Analysis

The analysis of FII DII data is expected to become even more sophisticated in the future. With advancements in technology, investors will have access to real-time FII DII data, allowing for more agile decision-making. Additionally, the integration of artificial intelligence and machine learning in financial analysis will enable more accurate predictions based on FII DII data trends. As the financial markets continue to evolve, the importance of FII DII data in guiding investment strategies will only grow.

Conclusion

In conclusion, FII DII data is a vital tool for investors seeking to understand and navigate the stock market. By providing insights into the trading activities of institutional investors, this data helps in predicting market trends and making informed investment decisions. Whether you are a seasoned investor or a newcomer to the market, understanding FII DII data and its implications can significantly enhance your investment strategy. As the financial markets continue to evolve, staying updated with FII DII data will remain crucial for successful investing.

FAQs

1. What is FII DII data?

FII DII data refers to the trading activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) in the stock market, providing insights into their buying and selling behaviors.

2. Why is FII DII data important?

FII DII data is important because it reflects the sentiment of institutional investors, helping individual investors predict market trends and make informed decisions.

3. How can I access FII DII data?

You can access FII DII data from stock exchanges like NSE and BSE, as well as financial news platforms and investment research websites.

4. How does FII DII data affect stock prices?

FII DII data affects stock prices as large-scale buying by FIIs can drive prices up, while significant selling by FIIs or DIIs can lead to a market downturn.

5. How can I use FII DII data in my investment strategy?

You can use FII DII data to align your investment strategy with market trends, adjusting your portfolio based on the buying and selling patterns of institutional investors.